The World Cup is historically one of the most important periods for the electronics sector — and no product feels this impact as much as TVs. In the months leading up to the tournament, consumers usually renew their equipment in search of better image quality, sound and connectivity. The 2026 edition, which begins on June 11 in the United States, Canada and Mexico, should repeat this movement. Manufacturers and retailers are already mobilizing with new technologies, dedicated campaigns and commercial strategies to take advantage of the power of the event.

According to Alexandre Gleb, TV product manager at Samsung Brazil, the period is strategic, and the sector’s confidence is based both on sales history and on reading new consumer demands. “There is a significant increase in the search for models with larger screens and features that provide greater immersion, such as high resolution, surround sound and smart connectivity,” says Alexandre. “More than a simple device replacement, Brazilians see this purchase as a way to elevate their entertainment experience,” he adds.

The peak in sales for the end consumer, according to Bernardo Pontes, executive director of AIWA Brazil, occurs about 30 to 45 days before the debut of the Brazilian national team, a moment when families and establishments organize to equip spaces and turn the experience of watching soccer into a collective event. “Our expectation is growth in sales, with a consumer more attentive to cost-benefit, without giving up performance and design,” says Bernardo.

At LG, expectations are also positive. The company projects growth above 10% in the premium segment and is betting on the public’s desire for big screens. “The consumer wants to feel inside the stadium. That is why our strategy focuses on models above 75 inches, which transform the living room into a true arena,” says Diego Oliveira, TV manager at LG.

The Era of Giants TVs

The World Cup often debuts important technological advances. It was like this in 1970, with the first color broadcast; in 1998, with the beginning of the digital signal; in 2010, with high definition; and in 2014, with the arrival of 4K. In 2026, the industry is aiming at large and ultra-large screens. A study by Omdia points out that, although global TV growth has modest projections in the coming years, the ultra-large segment (80 inches or more) should expand by 44% between 2025 and 2029.

Sales of this type of TV should jump from 9 million units in 2025 to more than 10 million in 2026, reaching 13 million in 2029. This trend has guided manufacturers operating in Brazil. Since the second half of 2025, they have been presenting screens with unprecedented dimensions. One highlight is the 116-inch model from the Chinese company Hisense, whose width reaches 2.63 meters. The company, a global leader in screens above 100 inches, is also an official sponsor of the FIFA World Cup.

The advance of giant TVs has been driven by a range of technological innovations, in a race to develop processors with artificial intelligence capable of optimizing image and sound in real time, upscaling systems that convert any content to 4K or 8K, as well as sophisticated panels with high contrast, fluidity and brightness, ensuring quality even in very well-lit environments. These are cutting-edge resources and technologies to captivate the consumer willing to spend more during the purchase.

Opportunities on several fronts

Although super-large TVs attract attention, they are not retail’s only focus. According to Mateus Rabelo, senior manager for customer success at NielsenIQ, there are opportunities on several fronts, including entry-level screens with a more accessible average ticket. “Our projections show that the main highlight segments are between 43 and 53 inches, with HD Ready and 4K resolutions,” says. “Among the more premium models, QLED technology stands out,” he adds.

According to the consultancy, screen size is the main design attribute considered in the purchase, mentioned by 70% of consumers. Among technological features, the availability of apps and the quality of image and sound weigh more. Advanced AI features, on the other hand, still appear in less than 10% of mentions.

Prices also favor migration to larger screens. Although the average price of the TV category has increased since the pandemic, both due to the inflationary effect and changes in the assortment mix, it is possible to notice a reduction in the price of larger screens. “One of the reasons is the growth in sales of large-screen models with simpler technologies, which fit into the so-called affordable premium,” explains Mateus Rabelo. Models of 75 or 86 inches, previously inaccessible, become more viable and enter the consumer’s radar.

In retail, preparation has already begun. An example of this is the “TV Programada” campaign, launched in October by Consórcio Magalu, which offers quotas of up to R$ 7.000,00 for the purchase of TVs up to 85 inches. “We want the customer to be able to plan the purchase, organize the budget and receive the TV at the right time to enjoy the games,” says Angélica Urban, operations director at Consórcio Magalu.

Connected Entertainment Hub

The role of the TV as the center of the home is strongly returning — but now, in a fully connected way. According to data from the Continuous PNAD released by IBGE, the percentage of Brazilians who accessed the internet through a television jumped from 11.3% in 2016 to 53.5% in 2024. The cellphone continues to be the preferred device for internet access (98.8%), while the computer continues to fall, reaching the lowest index in the historical series (33.4%).

The data reflect the growth of streaming platforms and the consumption of digital content, which is migrating from the cellphone screen to the living room. Research by Kantar IBOPE Media, presented at Brandcast 2025, reaffirms the trend, showing that TV surpassed the smartphone as the main access screen to YouTube within households. More than 80 million people are watching YouTube via TV, and the share of CTV (Connected TV) jumped from 41% to 53% in three years.

For Matheus Benatti, marketing and products director at Hisense in Brazil, there is a clear transformation in the habit of watching TV, with the big screen again occupying a central position, but now integrated with the internet, interactivity and hybrid consumption (TV + second screen). “In the market, this requires manufacturers to deliver image and sound quality commensurate with the living-room experience, native connectivity, intuitive interfaces and support for streaming apps and hybrid platforms,” he says.

The change in content consumption should be intensified in the 2026 World Cup. For the second consecutive edition, CazéTV secured the broadcasting rights for FIFA World Cup games on YouTube, exclusively. Keeping an eye on this increasingly connected audience, Globo launched in September GE TV, its open digital sports channel, bringing together presenters and commentators strongly connected to the online universe.

Content Convergence

For Eason Cai, CEO of TCL SEMP and president of the TCL Latin America Business Group, the new habits of content consumption not only redefine the experience of watching TV but also open opportunities for the electronics and entertainment market. “We are following this evolution closely. Our streaming platform, TCL Channel, closed strategic partnerships with GE TV and CazéTV for the broadcasting of major sporting events,” he says.

The arrival of the DTV+ standard, expected to debut during the 2026 World Cup, should bring an advance in interactivity and connectivity for Brazilian open TV. The so-called TV 3.0 will have its implementation phased, starting with the major capitals, but it already opens a new chapter for the market.

“New partnerships between TV brands and digital channels/content producers may become more frequent,” evaluates Mateus Rabelo, from NielsenIQ. “In addition, app access interfaces with good usability can become important differentiators,” he adds. The expectation is that, in the future, TVs will already leave the factory with support for the new standard, opening a demand cycle that should stimulate upgrades in the long term.

Bruno Morari, marketing and products director at Philips, agrees that TV 3.0 is still a technology in a maturation phase. “We believe its impact will be more significant in the next World Cup editions and in future events,” he says. “At this moment, the consumer tends to seek televisions that deliver high image quality and features that ensure an excellent experience during the tournament and in everyday use,” he adds.

With an increasingly connected consumer eager for larger screens, the 2026 World Cup has everything to be a strategic window for Brazilian retail. The event combines strong emotional appeal with the desire for immersion. To turn the cheering atmosphere into solid results at the point of sale, the path is clear: anticipate with a balanced mix of screens, assertive communication and actions that facilitate the consumer’s purchase planning.

Where to watch

CazéTV has the broadcasting right to all 104 matches of the FIFA World Cup 2026 on YouTube. Globo will broadcast 52 games on its various platforms: on open TV (TV Globo), pay TV (SporTV), streaming (Globoplay) and on its new digital channel, GE TV (except YouTube). SBT, in partnership with the N Sports channel, will air 32 matches, including the games of the Brazilian National Team.

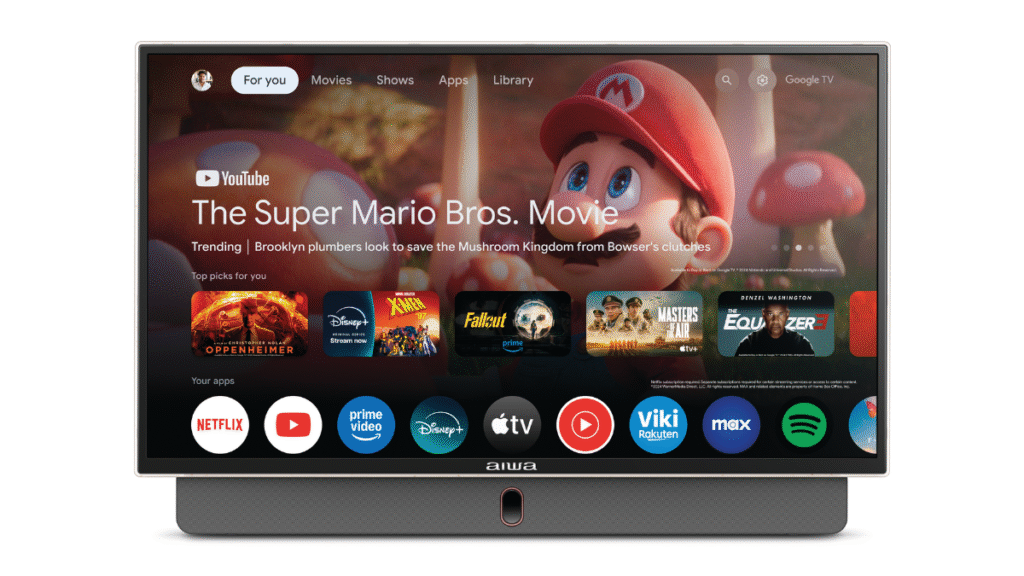

Aiwa

The 75-inch AIWA delivers 4K Ultra HD resolution with HDR10 and HLG, ensuring sharp images, vibrant colors and precise contrasts. The Dolby Vision and Dolby Atmos package expands visual and sound quality, offering an immersive experience. The ultrathin-bezel design reinforces the minimalist look, while the Google TV operating system provides intuitive navigation and access to the main streaming services. Suggested price (31/10/2025): R$ 7.999,00.

The AIWA Portable Smart TV brings the Google TV experience for use in parks, trips, camping or moments of power outage. It features a battery with autonomy of up to three hours, carrying handle, matte antiglare screen and remote control with voice command, in addition to modern audio and video features for a complete entertainment experience. Suggested price (31/10/2025): R$ 2.999,00.

Hisense

Equipped with HDR10+ and Dolby Vision technologies, the 100-inch Q7 QLED delivers vibrant images, improved contrast and more vivid colors. Thanks to its QLED Ultra HD panel, each scene is displayed with richness of detail. The 4K AI Upscaler optimizes low-resolution content to quality close to real 4K, ensuring definition even in old videos or on streaming. Suggested price (30/10/2025): R$ 16.000,00.

The largest single-panel TV in the world and the largest available in the Brazilian market, the 116-inch giant features RGB Mini-LED technology that offers precise contrast, 8,000 nits of brightness and 95% coverage of the BT.2020 standard. It has a 165 Hz refresh rate and an audio system developed in partnership with the French company Devialet (CineStage X Surround 6.2.2 system). Suggested price (30/10/2025): R$ 149.000,00.

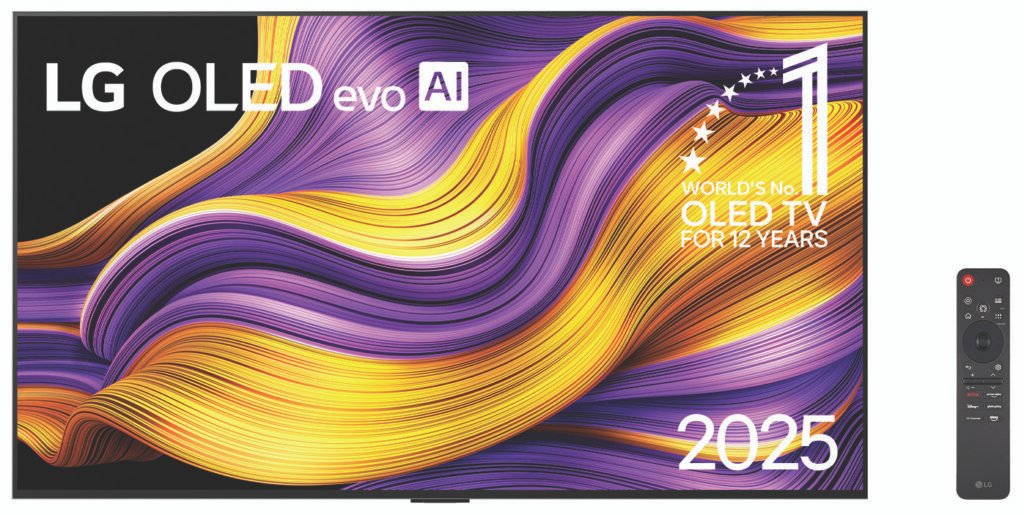

LG

It brings an OLED panel with self-lit pixels for pure blacks, infinite contrast and faithful colors. The new Alpha 11 AI Gen2 processor delivers more performance and speed, while Brightness Booster Max increases brightness by up to 70% to highlight HDR content. Intelligent surround audio increases immersion, and the webOS system with AI Magic Remote offers intuitive control and updates for up to five years. Suggested price (04/11/2025): R$ 9.399,00 (55”), R$ 15.699,00 (65”), R$ 149.999,00 (97”).

It combines the Alpha 9 AI Gen8 processor with self-lit OLED technology, offering infinite contrast and faithful colors. AI Picture Pro enhances faces and details, while AI Sound Pro separates voices from background noise. Brightness Booster provides up to 30% more brightness, highlighting nuances in HDR scenes. AI Magic Remote ensures smooth and intelligent control, with voice commands and the new AI interface. Suggested price (04/11/2025): R$ 7.299,00 (55”), R$ 13.999,00 (65”), R$ 22.999,00 (77”).

Philips

Philips’s The Xtra brings MiniLED technology, which ensures deep blacks, high contrast and realistic colors. It has the Philips P5 processor and Ambilight technology, expanding visual immersion. It offers 4K resolution, 120 Hz refresh rate and Google TV operating system. The FreeSync Premium feature delivers superior performance in fast scenes and games. Suggested prices (27/11/2025): R$ 4.399,00 (55”), R$ 6.199,00 (65”), R$ 8.999,00 (75”).

The One has 4K resolution and is available with 55-, 65- and 75-inch screens, which have Ambilight technology. Compatible with the main HDR formats, the model offers Dolby Vision and Dolby Atmos. It has a 120 Hz refresh rate, in addition to VRR and AMD FreeSync for fluid and responsive gameplay. Suggested price (27/11/2025): from R$ 4.300,00 to R$ 8.600,00.

Samsung

In addition to 4K resolution, the Crystal UHD adopts the “All in 1” concept: it is suitable for videogames and karaoke, and offers access to several free channels through Samsung TV Plus. With screens ranging from 43 to 85 inches, it adapts to different environments and usage profiles. HDR technology expands the range of light levels, providing more brightness, contrast and details.

The Vision AI Q7F has screens from 50 to 85 inches and a QLED panel with blue LEDs and quantum dots, ensuring intense brightness, deep blacks and color fidelity. Vision AI Companion offers interaction via generative AI, answering questions in real time based on the content displayed. It includes gesture control via Galaxy Watch and a karaoke mode with more than 100 thousand songs, using the smartphone as a microphone.

TCL

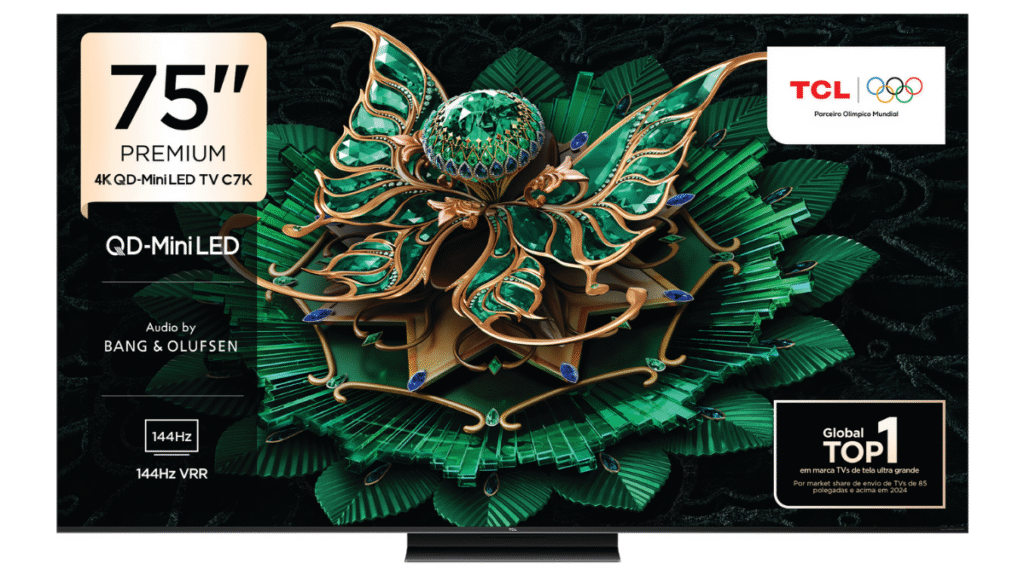

The C7K features a QD-Mini LED panel with 4K resolution, offering deep blacks, precise contrast and a wide color gamut. The AiPQ Pro processor uses AI to automatically optimize color, motion and HDR. It is compatible with Dolby Vision IQ and HDR10+, which adapt brightness and contrast scene by scene. The 65- and 75-inch versions come with a Bang & Olufsen sound system. The 115” model brings a sound set by Onkyo. Suggested price (31/10/2025): R$ 8.199,00 (65”) and R$ 9.299,00 (75”).

The C8K combines a next-generation QD-Mini LED panel with an ultrathin ZeroBorder design (less than 4 mm), delivering maximum screen use and premium aesthetics. The Bang & Olufsen sound system complements the performance proposal. For gamers, the highlight is the 288 Hz VRR Game Accelerator, which increases fluidity from the native 144 Hz rate, together with the CrystGlow WHVA panel, which ensures image quality. Suggested price (31/10/2025): R$ 15.999,00 (85”).